High-impact display ads should not be overlooked as a revenue driver

By ResponsiveAds - Dynamic

In the recent IAB/PWC Internet Advertising Report 2021 released in April 2022, digital advertising came in at US$189 billion, and year-over-year growth for total digital ad revenues climbed 35.4%, which is the highest increase since 2006.

As more money moves to digital, digital publishers are constantly asking how they can take advantage of the growth and get beyond their fair share.

In addition to paid subscription opportunities and other content monetisation strategies, building the strongest display advertising business possible is one of the best ways to guarantee success for advanced revenue growth.

With the shift to digital, there has also been a shift toward programmatic, pre-bid, header bidding, and data optimisation driving advanced audience selling strategies. These can definitely bring more payments through the programmatic pipes, but selling high-impact display is a basic strategy not to be overlooked, as it offers more control over your revenue future.

Ad map and ad units

Many publishers have built page and layout strategies based on ad specifications that date back to the late 1990s. The 970×250, 300×600, 300×250, and 728×90 layouts have become the standard formats for buying and selling media. They are clearly outdated, but they are still the status quo.

They do not drive the most revenue possible. You need to find partners to make your own inventory more valuable with new formats that better leverage the spaces on the page. Big edge-to-edge placements will immediately increase ad engagement and click-through performance, thus offering the opportunity to re-evaluate your rate card.

Engagement is defined as the clicks and hovers (or mouse-overs) on an ad creative.

We found overall that, after billions of impressions served, you can expect at least four times the click-through rates (CTR) and 20 times the engagement rate by leveraging inventory that goes full-bleed and eliminates white space around the ads. (The Google Rich Media 2017 Metrics Report showed standard CTR was 0.05~0.1% and engagement 2.14%.) Creative that fits naturally is like “rich media” native advertising. Assuring spaces are filled beautifully to fit your page’s layouts is a simple creative advantage that can bring value to your advertising clients.

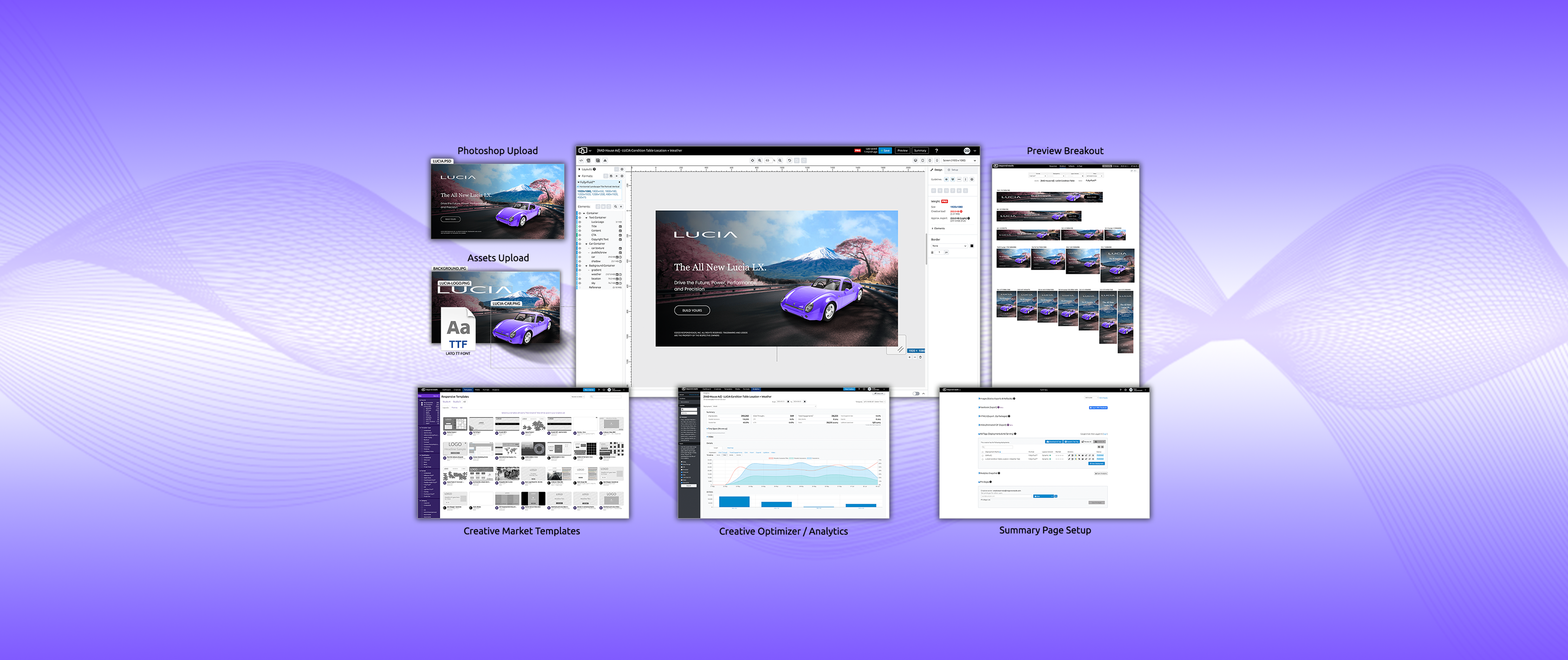

You do not need to change your site code or re-layout your site. You just need to define the ad map that maximises the size of the ad “footprint” and eliminates the white space around the ads. Of course, looking for the right responsive or fluid ads to fill these spaces is the next step, but setting up your ad units in your primary ad server (such as Google Ad Manager or Xandr) so they are either fluid placements or tagged to accept edge-to-edge responsive ads is critical for even programmatic. That way if there are programmatic buys that offer higher-paying demand, you can open up your supply immediately for these options.

A very common ad unit is either a 4×1 that goes edge-to-edge across the top of your top placement or even a fluid 250 (meaning the max width yet 250 pixels high). It is a perfect unit that can expand the 970×250 unit to go edge-to-edge and eliminate the white space on both sides.

We call this “footprint optimisation.” It is a process of getting the best balance of the number of ads and sizes across the different slots on the page or ad map, offering the best balance between editorial and ads. Of course, native ad units can come into the scope of this conversation as they add in balance and are also fluid in nature but very much embedded into the editorial content itself.

New creative types

In addition to understanding your ad map and the key ad units that can drive a revenue strategy, it’s also important to identify the types of creative that can be sold at a premium due to performance for those clients or advertisers.

There are unlimited creative types that can be executed. However, we can simplify by putting them in the following categories:

- Static: These are standard display ads that have a message and could be delivered as an image file.

- Animated: These include animated elements that add some motion to catch consumers’ attention.

- Advanced animation: Including animation triggered by an action by the user, this could be parallax scroll or click-to-activate.

- Video: When the autoplay video is added to the banner it is called in-banner video (IBV).

- Full-bleed video: When the entire ad is a video, it provides high-impact experiences.

- Interactive: This is when there are interactive components like a lead-gen form, survey, or configurator to select different colours.

Adding features can encourage engagement or spark attention with value to the end user. If we put these categories in an ideal order, clearly the more interactive an ad becomes, the more engaging it potentially is for the end user. This can also bring a lot of value for advertisers to drive awareness and performance.

“Ad”-ding it up

When we look at the different ad units and creative placement — from standard Interactive Advertising Bureau to full-bleed — and then we add in the creative ad time, there is an interesting multiplier effect for user engagement.

The largest footprints with interactive ads can have engagement values as much as 200 times standard industry rates.

Revenue strategies for selling alignment

By looking to high-impact display ads as a key focus, there are lots of benefits to monetising as well as approaching the next generation of programmatic. We believe the next types of high-impact display creative will become more mainstream with the shift of ad dollars to digital and the growth of rich media and video as media.

Publishers that embrace this new ad unit strategy while building partnerships with creative platform providers can enable different creative types beyond the standard “static ads.” This opens up the opportunity to define your own premium rate card strategy and sell at a premium. We have seen publishers selling at 10 times programmatic pay rates. The only question is: How do we better scale this strategy?

Related posts